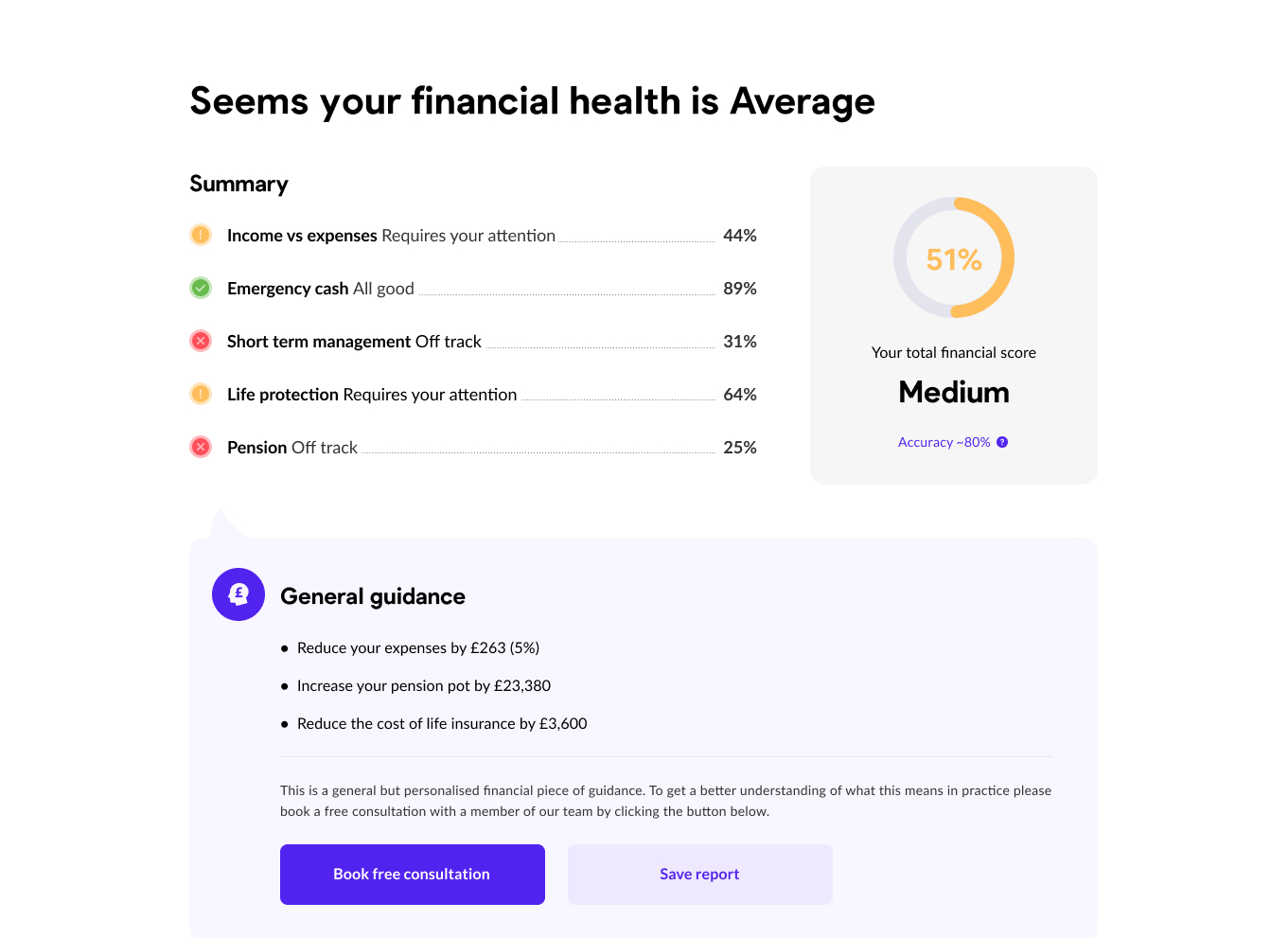

Whether you have a specific investment goal, want to take stock of your overall financial situation, review all your assets, set up or consolidate your pensions, take out a mortgage or have other finance related issues you need to review.

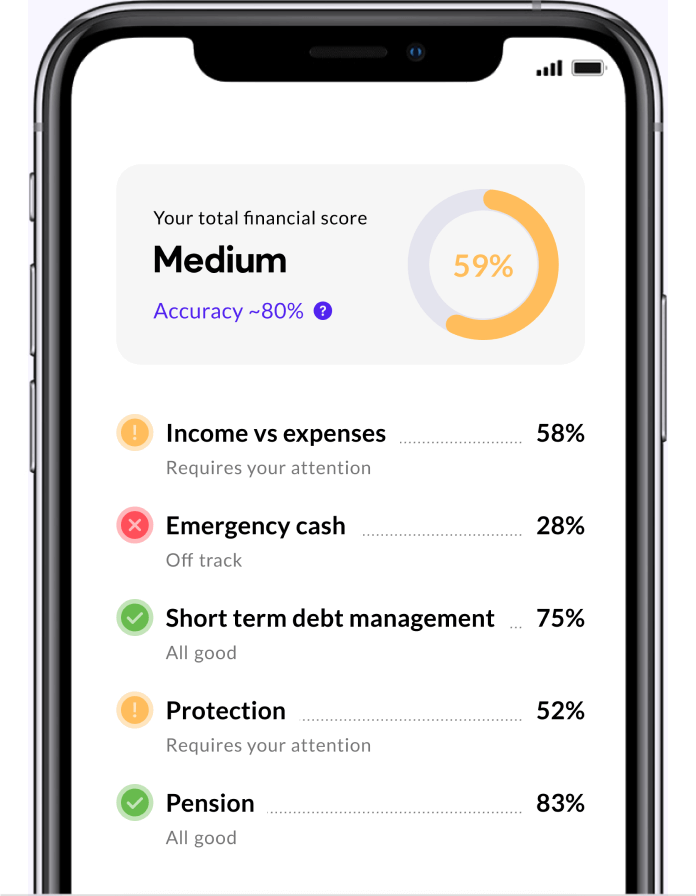

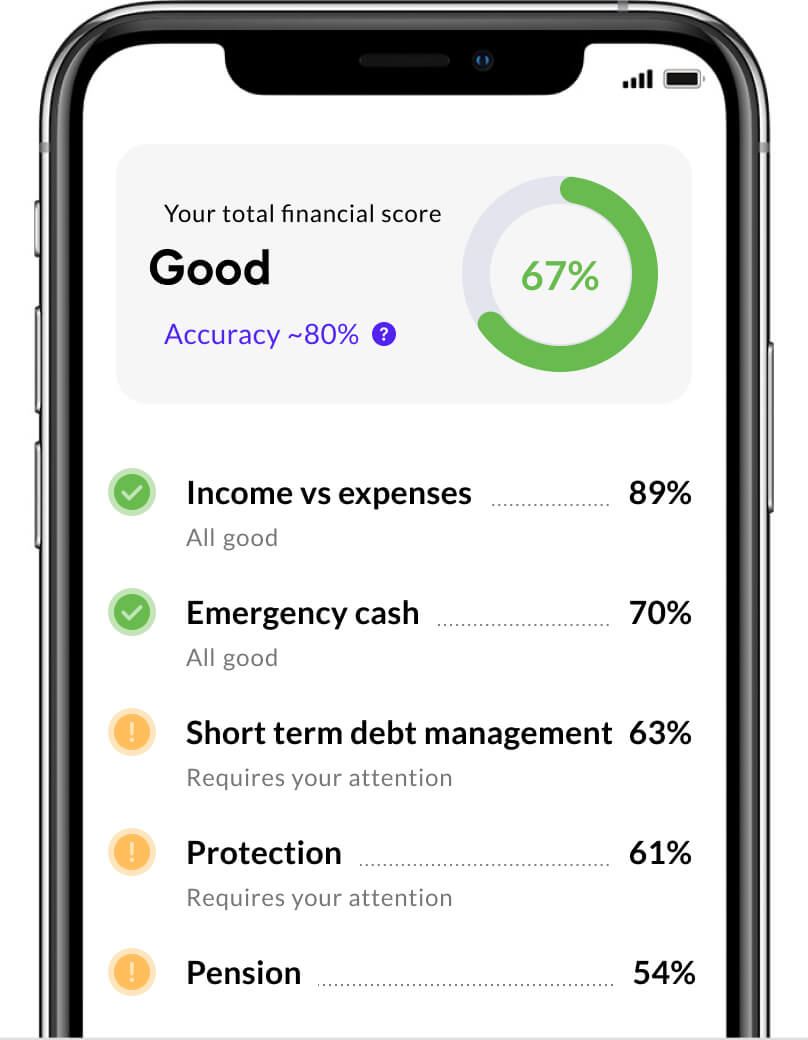

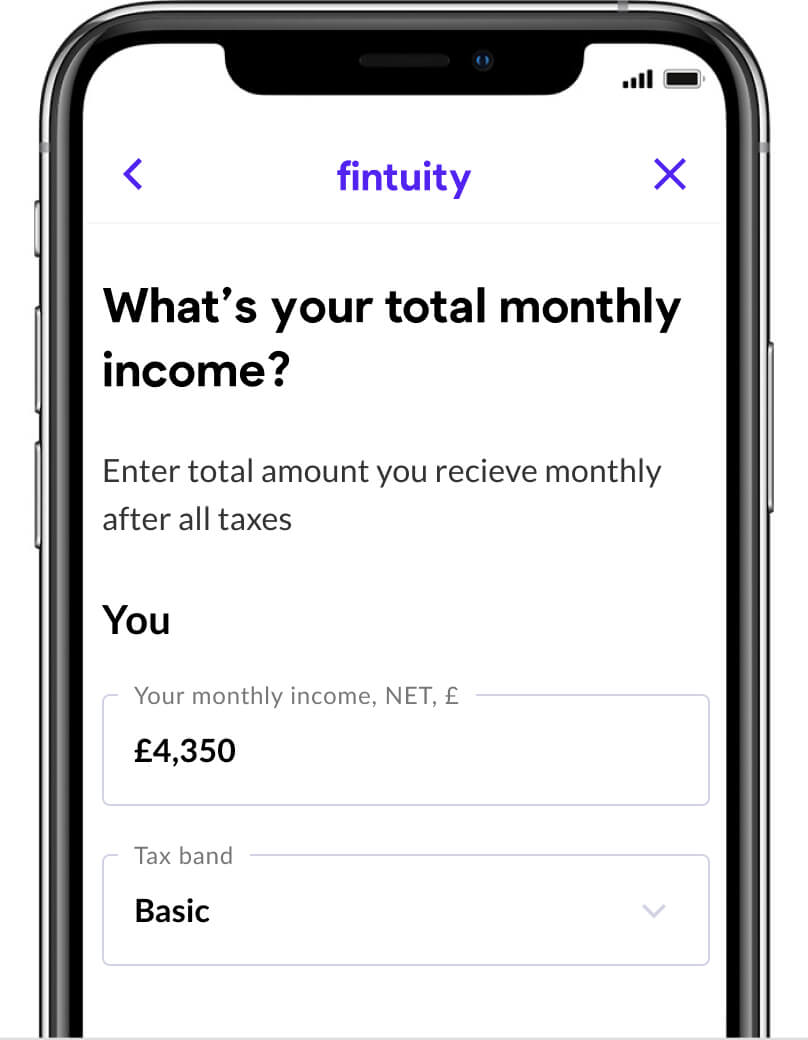

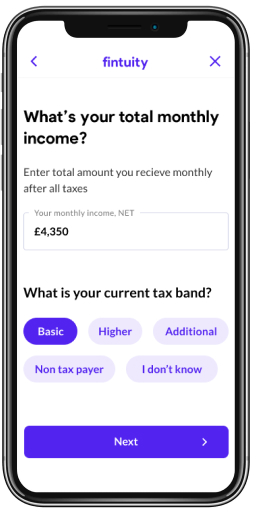

A financial health check is an essential and helpful tool in allowing you to take control and make your finances work for you. Fintuity Virtual Adviser is a highly advanced online tool that delivers instant, bespoke and accurate financial suggestions to you.