Video

Who is fintuity in 2 minutes

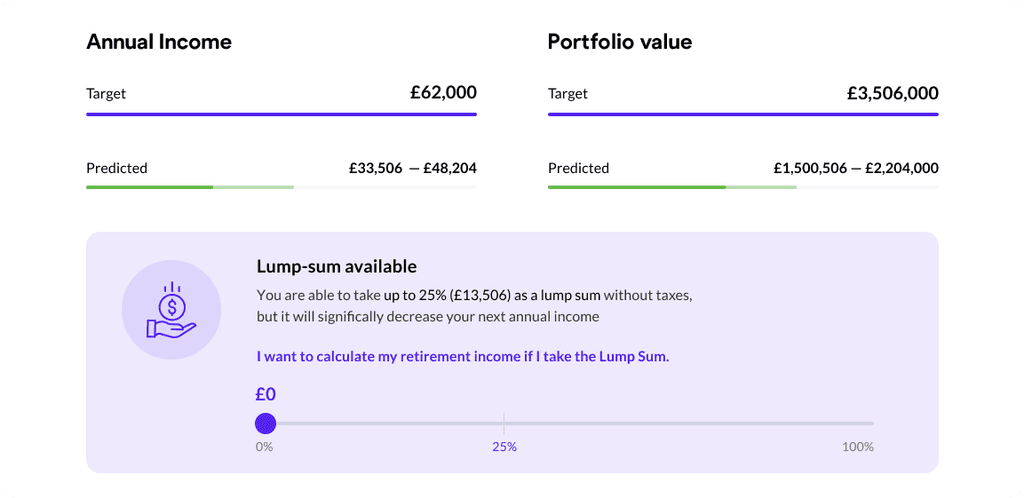

Analyse, manage, consolidate or transfer your pension savings with fintuity

We can help you with

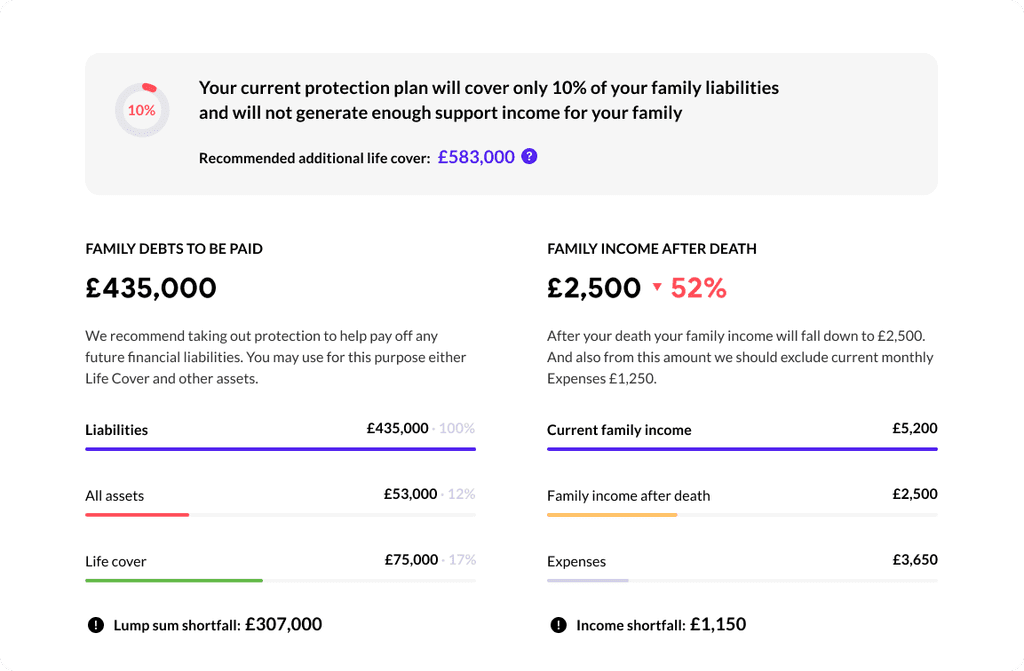

Insurance

Cover your mortgage payments, income and other key liabilities with life insurance.

Illness Cover

Receive financial support if you are diagnosed with a critical condition.

Replacement

In case of a major loss of income, you can ensure a proportion of your income is maintained.

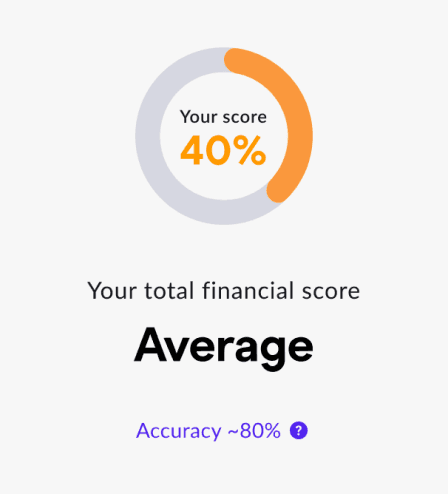

In the case of a sudden loss of income or unexpected illness, having the right cover is crucial to overcoming the problems brought by a change of circumstances. In short this can mean a world of difference to you and your family, should the worse happen.

Our advisers will be on hand to assess your income and anticipated expenditures in order to identify the right policies for you and your family. Constantly updated, we are also delighted to offer the latest protections advice and news, as well as detailed explanations of common types of protections cover through our Protections Knowledge Base.

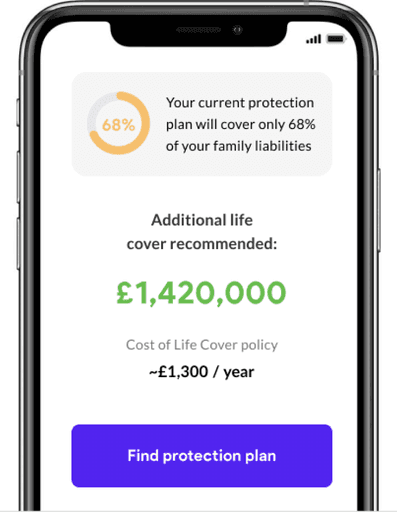

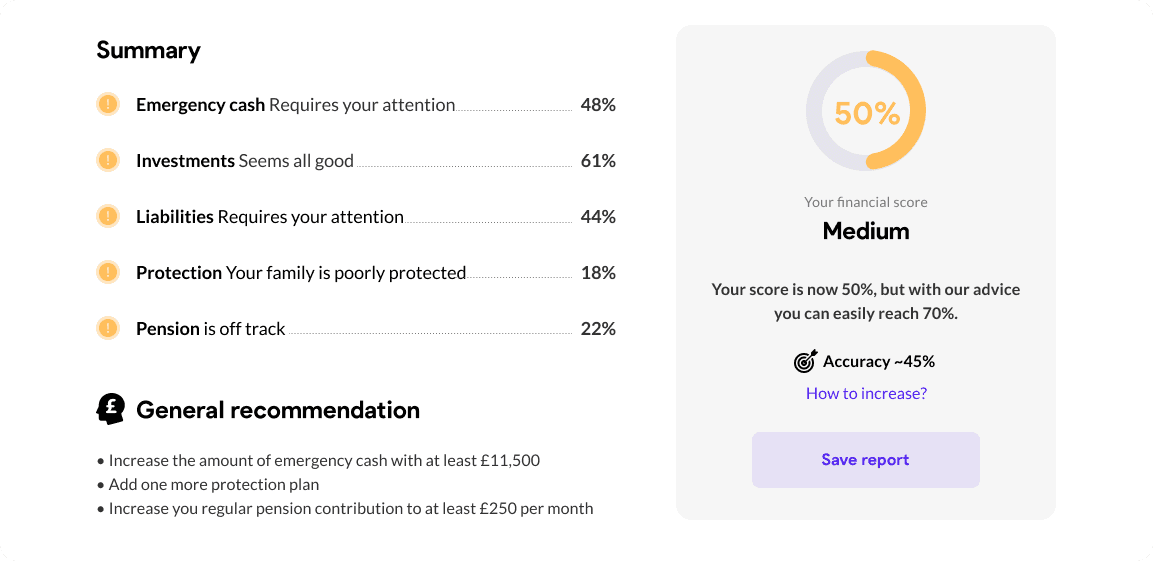

Assess the amount of cover that you might need

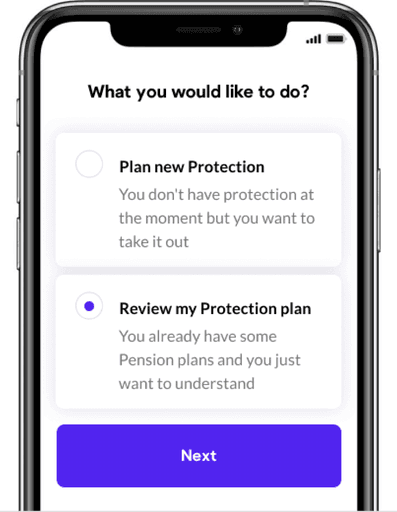

In order to fully understand what sort of cover might be needed, our team will need to first of all work out exactly how much cover you need to cover your outgoings and potential income loss.

We will then work with you to identify an affordable and comprehensive plan that will give you and your family a peace of mind.

Your initial discussion is complimentary and this will help us to understand your financial needs

Initial meeting ~15 minutes

About Fintuity

Founded in 2017, Fintuity is a fully digital and FCA regulated Independent Financial Adviser (IFA) that provides a range of services via our proprietary online platform. Fintuity is a wholly online, secure and cutting edge platform that delivers compliant and bespoke advice at below-industry rates.

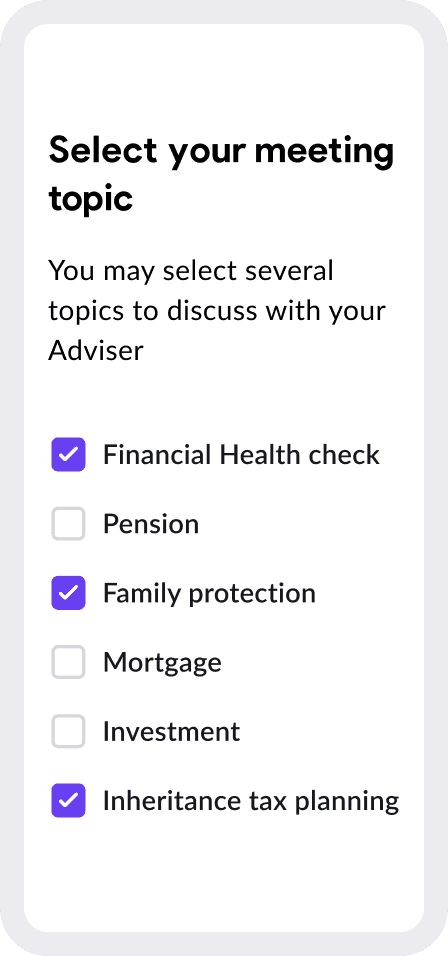

Book a free consultation

Your first consultation is completely free of

charge - all you need to do is to select a

convenient time & date and outline how we can

assist you.