Fintuity Briefings – What Are the Key Drivers Behind the Spring Budget?

After a positive start to 2023, the markets rolled back some of their gains in February following a series of surprises with regards to growth forecasts, the labour market and inflation, leading to concern that interest rates may peak at higher levels than first thought.

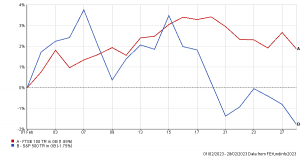

The Bank of England also recently raised the base rate to 4% and estimates predict that rates will peak at around 4.5%. There is however a cause for optimism in that annual inflation in February fell to 10.1%, down from 10.5% in January. The BoE now expects inflation to fall to around 4% by the end of the year and drop below is 2% target in Q1 2024. The FTSE 100 also reached 1.89% in February reaching new heights trading above 8,000 before falling back down towards the end of the month, with the S&P 500 down -1.75%.

What happens here in the UK is often mirrored globally and the US Federal Reserve also raised its benchmark by 0.25%, with the slower rate rise indicated that the Fed’s view is inflation has peaked. Other figures from across the pond all pointed to a more optimistic view of the US’ economic situation, with a potential 500,000 new jobs created in January and strong retail sales figures.

Across the Channel in Europe, equity markets have been quite resilient, despite concerns that the ECB would be more aggressive in their efforts to curb inflation. It is also worth noting that Chinese equity had also been boosted in recent months following the post-lockdown reopening of their economy with February seeing drops in the markets as investor sentiment turned slightly sour.

Ensure That Your Finances Are Working as They Should be

Fintuity are able assist you in several ways of modelling and managing your personal finances, including:

- A cutting edge Virtual Adviser with an optional complimentary IFA meeting

- An extensive library of up to date financial advice, as well as a searchable blog with hundreds of articles

Introducing Fintuity – The UK’s Digital IFA!

Fintuity is like a traditional IFA, only we are an online adviser which means we can offer a more cost effective, time-sensitive and flexible service! We offer the full range of IFA services via our digital platform, at below industry rates and at your convenience. Please do not hesitate to get in touch to see how we can assist you.

For all enquiries please visit www.fintuity.com or email support@fintuity.com

Please Note: All information, references and dates included in this article were accurate at the time of publishing.