Video

Who is fintuity in 2 minutes

Manage and optimise your investment portfolio with the help of our expert advisers

We can help you with

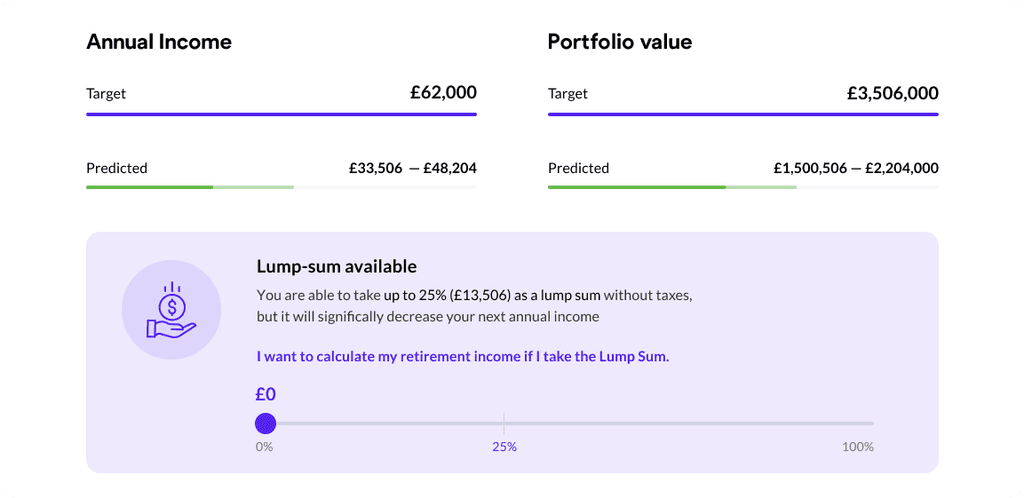

Portfolio

We will begin by assessing your existing portfolio and will give you helpful advice to manage your current investment portfolio to its maximum capacity.

Review Your Existing Portfolio

If you have an existing investment portfolio, we can help you review your existing provisions.

Develop a Personalised Investment Roadmap

If you are looking to develop a new portfolio or amend an existing one, we can provide you with a fully bespoke investment roadmap to help maximise your returns.

Plan Investment Goals

We can help you identify and plan realistic investment goals that have the best chance of delivering a strong ROI.

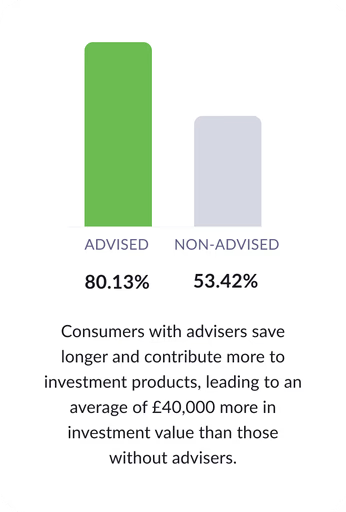

How we can help you with the right financial advice

Receiving expert financial advice is crucial to making the right investment decision. With the right support and advice from a regulated Independent Financial Adviser (IFA), you will be able to make the right investment decisions that match your personal financial circumstances. Your IFA will help to explain possible options open to you as well as the details of suitable financial products and investment strategies.

Constantly updated, we are also delighted to offer the latest tips and guidance through our Investment Knowledge Base.

Receive the best-in-industry investment solutions with the help of our advisers

We all want our money to grow and this can be achieved through smart investing.

With careful financial planning we can help you achieve your financial goals through through the development of a smart and responsive investment strategy.

The strategy will be based upon your attitude and approach to risk, financial circumstances and ultimately what you hope to achieve from the development of a smart investment portfolio.

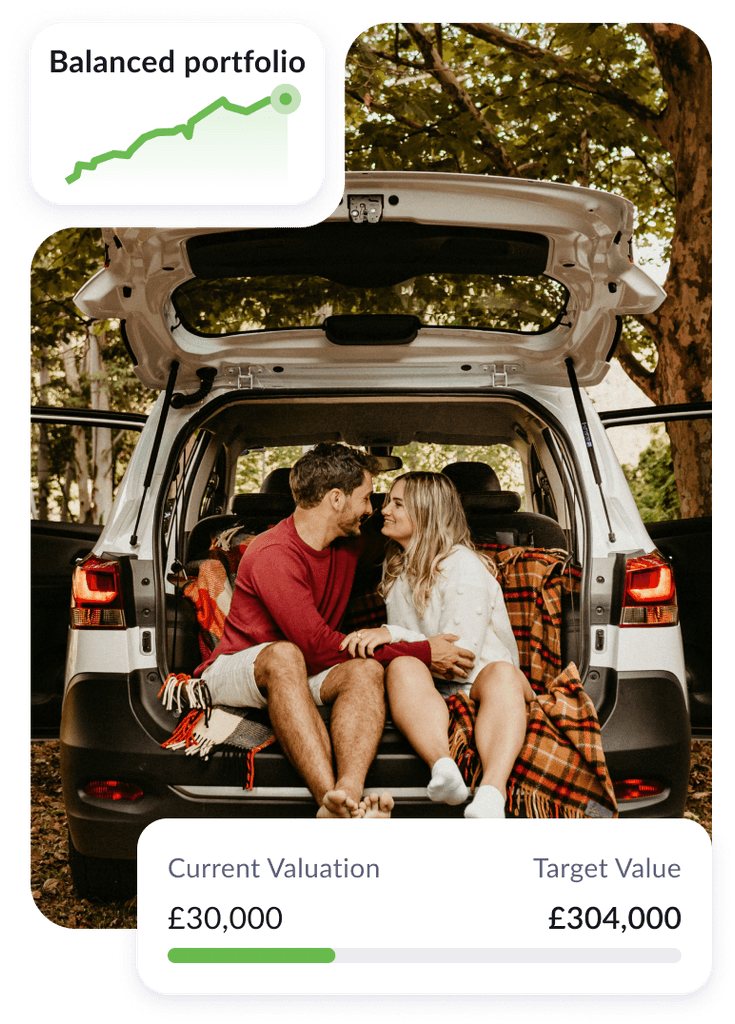

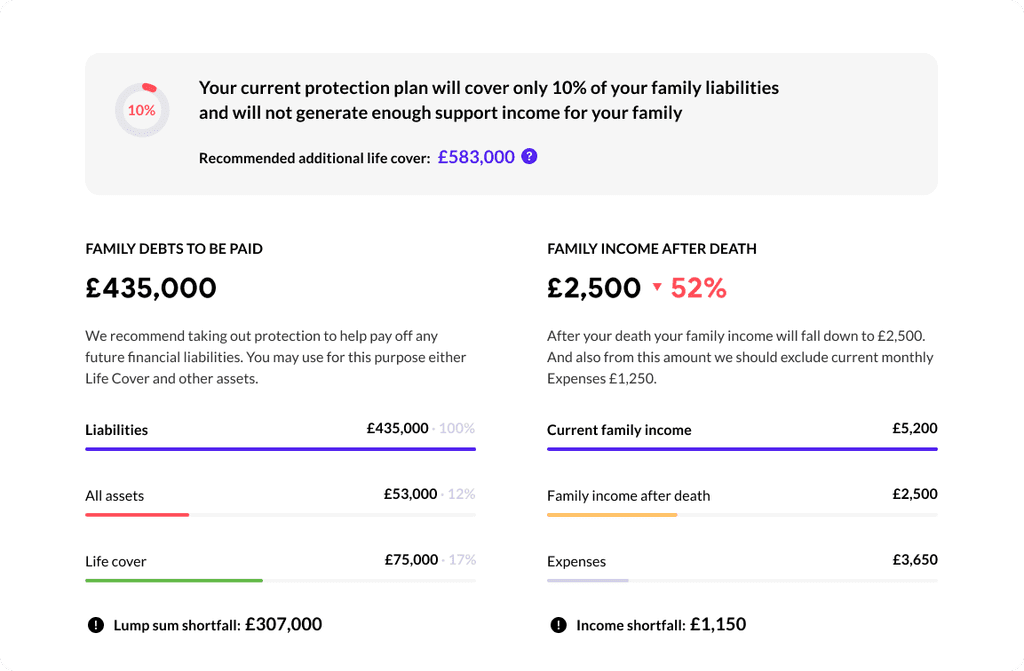

Monitor and analyse the the performance of your investment portfolio

Knowledge is key and with our innovative online and app based platform you can monitor your investment portfolio in real time.

Whilst you can access the plan at any time, you can also speak to your adviser to ensure that the portfolio is operating at its best, at all times.

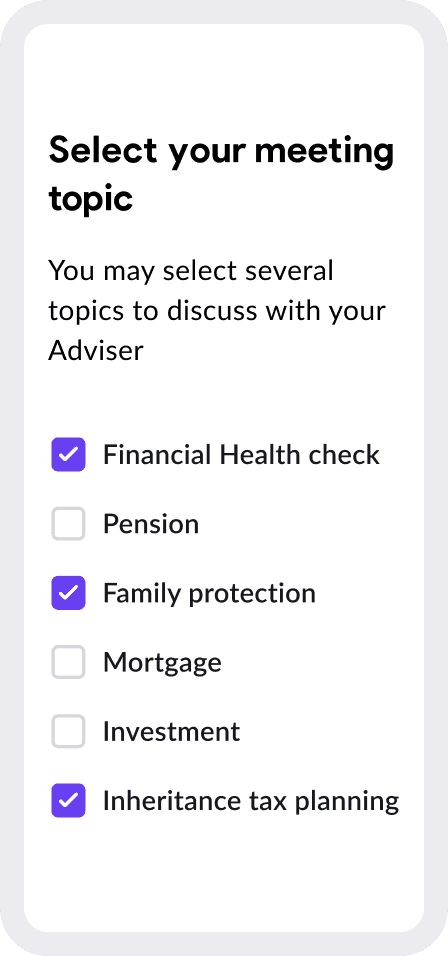

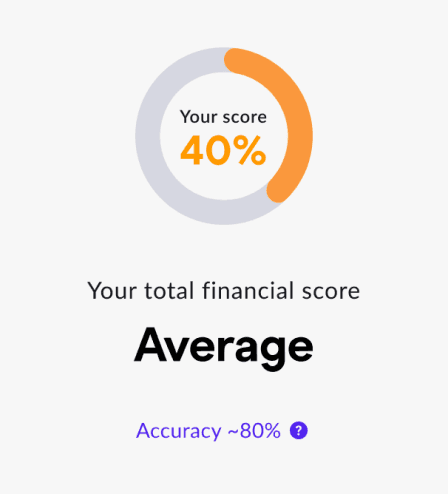

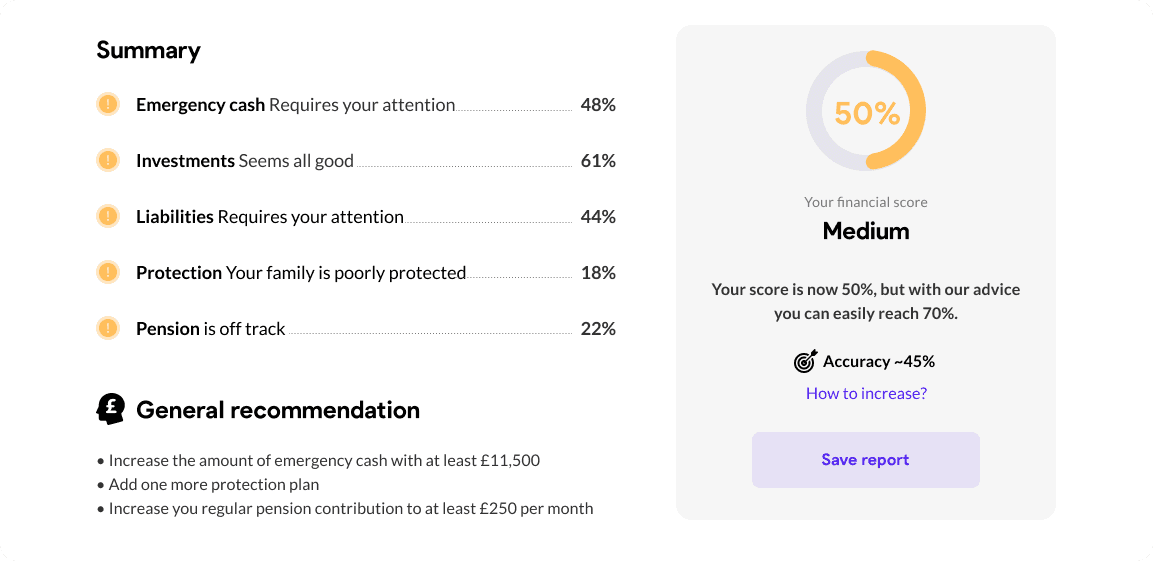

Virtual Adviser

Receive an instant investment review with our Virtual Adviser

Using our very own virtual adviser and in just 5 minutes, find out what investment options are open to you!

Estimated time ~5 min

Your initial discussion is complimentary and this will help us to understand your financial needs

Initial meeting ~15 minutes

About Fintuity

Founded in 2017, Fintuity is a fully digital and FCA regulated Independent Financial Adviser (IFA) that provides a range of services via our proprietary online platform. Fintuity is a wholly online, secure and cutting edge platform that delivers compliant and bespoke advice at below-industry rates.

Book a free consultation

Your first consultation is completely free of

charge - all you need to do is to select a

convenient time & date and outline how we can

assist you.