Modern Independent Financial Advice, Backed by Tradition

Modern Independent Financial Advice, Backed by Tradition

Modern Independent Financial Advice, Backed by Tradition

Trusted advice made simple – cost effective, secure and easy to access financial advice.

Who is fintuity in 2 mins

What does an independent financial adviser do?

Who Are Independent Financial Advisers?

Your free initial consultation is like a visit to your local General Practitioner where you can discuss your personal finances and get some “treatment” for anything that is not going as well as it could. An IFA can help you by:

• Providing regulated advice on how to manage your wealth: from investment planning, pension planning, protection planning, mortgage planning to inheritance tax planning

• Researching the marketplace and recommend the most appropriate products and services available

• Negotiates with providers for the best rates on a range of financial products

How we can help you with the right financial advice

Making the right investment decisions requires expert guidance. With support from our regulated independent financial advisors (IFAs), you’ll receive personalized advice tailored to your financial goals.

Our advisors explain all your options clearly and recommend financial products or investment strategies that match your needs. For ongoing guidance, explore our constantly updated Investment Knowledge Base.

How we can help you with the right financial advice

Making the right investment decisions requires expert guidance. With support from our regulated independent financial advisors (IFAs), you’ll receive personalized advice tailored to your financial goals.

Our advisors explain all your options clearly and recommend financial products or investment strategies that match your needs. For ongoing guidance, explore our constantly updated Investment Knowledge Base.

How we can help you with the right financial advice

Making the right investment decisions requires expert guidance. With support from our regulated independent financial advisors (IFAs), you’ll receive personalized advice tailored to your financial goals.

Our advisors explain all your options clearly and recommend financial products or investment strategies that match your needs. For ongoing guidance, explore our constantly updated Investment Knowledge Base.

How it works

1

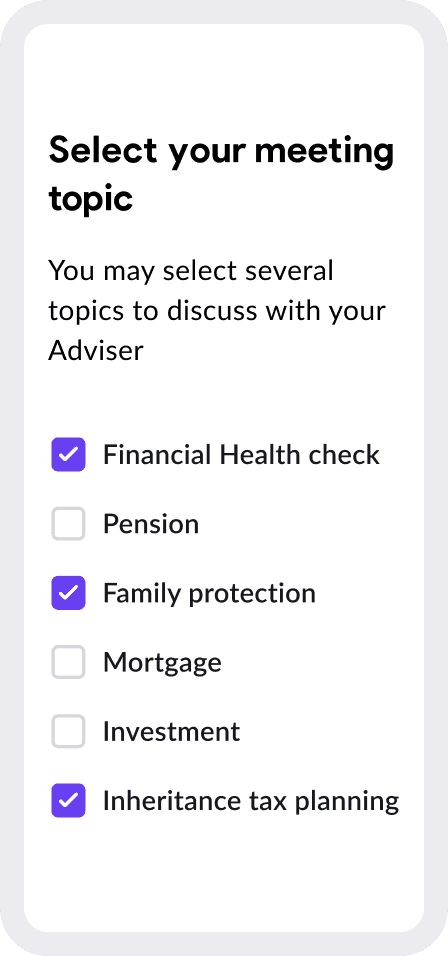

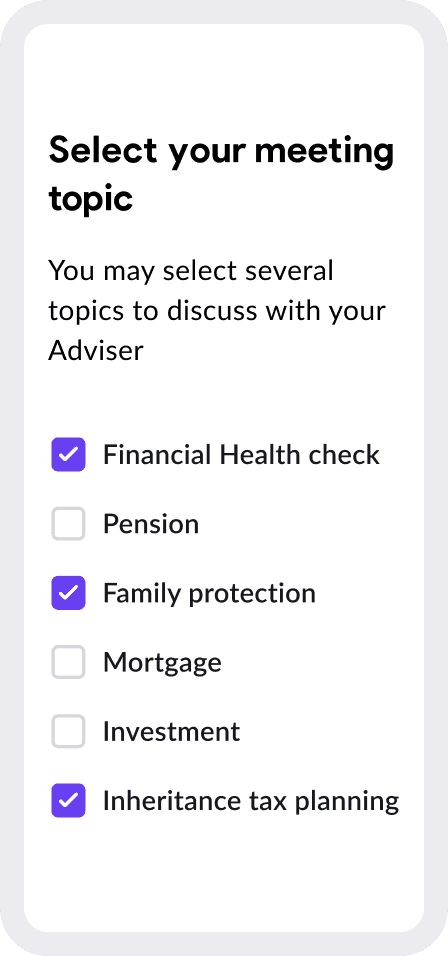

Book your first online meeting

Click 'Book your free consultation' to choose a convenient time for your initial meeting.

2

Meet your advisor

During your first session, your financial advisor will review your current situation and goals.

3

Get tailored advice

Receive a personalized financial plan designed to help you achieve your objectives.

How it works

1

Book your first online meeting

Click 'Book your free consultation' to choose a convenient time for your initial meeting.

2

Meet your advisor

During your first session, your financial advisor will review your current situation and goals.

3

Get tailored advice

Receive a personalized financial plan designed to help you achieve your objectives.

How it works

1

Book your first online meeting

Click 'Book your free consultation' to choose a convenient time for your initial meeting.

2

Meet your advisor

During your first session, your financial advisor will review your current situation and goals.

3

Get tailored advice

Receive a personalized financial plan designed to help you achieve your objectives.

Our services

Since 2017, Fintuity has been a leading provider of online financial advisory services in the UK. Our independent financial advisers (IFAs) deliver all the benefits of traditional advice through a secure, digital platform. Whether you need help with pensions, investments, mortgages, or protection, we offer significant savings and on-demand service.

Our services

Since 2017, Fintuity has been a leading provider of online financial advisory services in the UK. Our independent financial advisers (IFAs) deliver all the benefits of traditional advice through a secure, digital platform. Whether you need help with pensions, investments, mortgages, or protection, we offer significant savings and on-demand service.

Our services

Since 2017, Fintuity has been a leading provider of online financial advisory services in the UK. Our independent financial advisers (IFAs) deliver all the benefits of traditional advice through a secure, digital platform. Whether you need help with pensions, investments, mortgages, or protection, we offer significant savings and on-demand service.

We are here to help you

We are here to help

Your initial discussion is complimentary and this will help us to understand your financial needs

Initial meeting ~15 minutes

About Fintuity

Founded in 2017, Fintuity is a fully digital and FCA regulated Independent Financial Adviser (IFA) that provides a range of services via our proprietary online platform. Fintuity is a wholly online, secure and cutting edge platform that delivers compliant and bespoke advice at below-industry rates.

What our clients say

Firstly, by explaining the different facets of financial planning. Explaining the different options available, really helped me to get an understanding of what I felt was right for me. Secondly, he then went away and actioned everything discussed, with good communication along the way.

What our clients say

Firstly, by explaining the different facets of financial planning. Explaining the different options available, really helped me to get an understanding of what I felt was right for me. Secondly, he then went away and actioned everything discussed, with good communication along the way.

What our clients say

Firstly, by explaining the different facets of financial planning. Explaining the different options available, really helped me to get an understanding of what I felt was right for me. Secondly, he then went away and actioned everything discussed, with good communication along the way.

Fintuity in the media

Keep up-to-date with the latest finance and industry news & analysis with our blog!

Maximizing Your Savings in the UK: Simple Tips

Interest rates are rising, which means your savings can earn more for you than in recent years, but only if...

Navigating Money Dysmorphia: Understanding the Obsession with Wealth Among Gen Z and Millennials

Are Gen Z and millennials too focused on getting rich? It seems like it, and it might be causing...

UK State Pension Age Set to Rise to 71

Experts predict that soon, the retirement age in the UK will climb to 71. This change is deemed necessary due...

Read more from the Fintuity Blog

Keep up-to-date with the latest finance and industry news & analysis with our blog!

Maximizing Your Savings in the UK: Simple Tips

Interest rates are rising, which means your savings can earn more for you than in recent years, but only if...

Navigating Money Dysmorphia: Understanding the Obsession with Wealth Among Gen Z and Millennials

Are Gen Z and millennials too focused on getting rich? It seems like it, and it might be causing...

UK State Pension Age Set to Rise to 71

Experts predict that soon, the retirement age in the UK will climb to 71. This change is deemed necessary due...

Read more from the Fintuity Blog

Keep up-to-date with the latest finance and industry news & analysis with our blog!

Maximizing Your Savings in the UK: Simple Tips

Interest rates are rising, which means your savings can earn more for you than in recent years, but only if...

Navigating Money Dysmorphia: Understanding the Obsession with Wealth Among Gen Z and Millennials

Are Gen Z and millennials too focused on getting rich? It seems like it, and it might be causing...

UK State Pension Age Set to Rise to 71

Experts predict that soon, the retirement age in the UK will climb to 71. This change is deemed necessary due...

Read more from the Fintuity Blog

Subscribe to our newsletter

This site is protected by reCAPTCHA and the Google Privacy Policy Privacy Policy and Terms of Service apply.

Subscribe to our newsletter

This site is protected by reCAPTCHA and the Google Privacy Policy Privacy Policy and Terms of Service apply.

Subscribe to our newsletter

This site is protected by reCAPTCHA and the Google Privacy Policy Privacy Policy and Terms of Service apply.

FAQ

Should you have any queries about our services, fees or for any other matter please see below some of our most commonly asked questions. If you cannot find an an answer to your query please do get in touch. For more information and help please check out our Blog and Knowledge Base.

What is the difference between traditional financial advice and Fintuity’s virtual guidance service?

Is my personal information secure?

How much does this cost?

If I decide to act on the choices I make can I cancel?

Refunds after cancellation

If I have any questions about the choices or investments, who can I speak to?

FAQ

Should you have any queries about our services, fees or for any other matter please see below some of our most commonly asked questions. If you cannot find an an answer to your query please do get in touch. For more information and help please check out our Blog and Knowledge Base.

What is the difference between traditional financial advice and Fintuity’s virtual guidance service?

Is my personal information secure?

How much does this cost?

If I decide to act on the choices I make can I cancel?

Refunds after cancellation

If I have any questions about the choices or investments, who can I speak to?

FAQ

Should you have any queries about our services, fees or for any other matter please see below some of our most commonly asked questions. If you cannot find an an answer to your query please do get in touch. For more information and help please check out our Blog and Knowledge Base.

What is the difference between traditional financial advice and Fintuity’s virtual guidance service?

Is my personal information secure?

How much does this cost?

If I decide to act on the choices I make can I cancel?

Refunds after cancellation

If I have any questions about the choices or investments, who can I speak to?

Book a free consultation

Your first consultation is completely free of

charge - all you need to do is to select a

convenient time & date and outline how we can

assist you.

Resources

Fintuity is a trading name of Fintuity Limited, registered in England & Wales - Company No. 10849933. Fintuity Limited is authorised and regulated by the Financial Conduct Authority under reference number 814106.

128 City Road, London, EC1V 2NX

+44 1274 003920

support@fintuity.com

Resources

Fintuity is a trading name of Fintuity Limited, registered in England & Wales - Company No. 10849933. Fintuity Limited is authorised and regulated by the Financial Conduct Authority under reference number 814106.

128 City Road, London, EC1V 2NX

+44 1274 003920

support@fintuity.com

Resources

Fintuity is a trading name of Fintuity Limited, registered in England & Wales - Company No. 10849933. Fintuity Limited is authorised and regulated by the Financial Conduct Authority under reference number 814106.

128 City Road, London, EC1V 2NX

+44 1274 003920

support@fintuity.com