Video

Who is fintuity in 2 minutes

Manage and optimise your investment portfolio with the help of our expert advisers

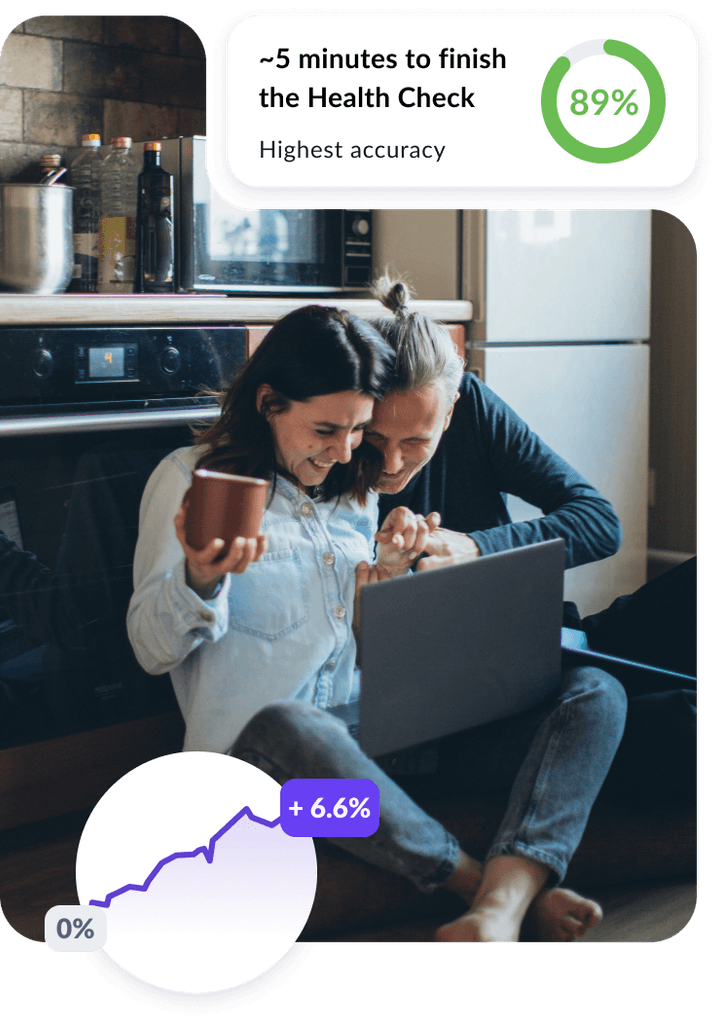

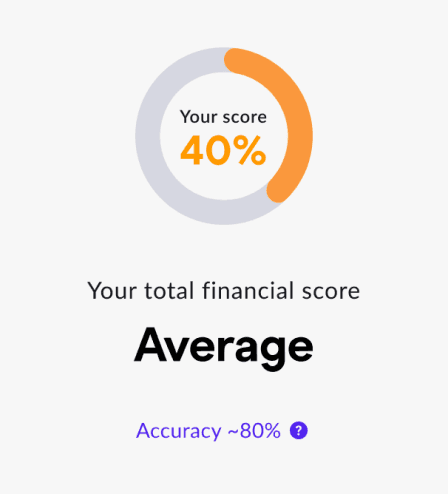

What’s a Financial Health Check?

Whether you have a specific investment goal, want to take stock of your overall financial situation, review all your assets, set up or consolidate your pensions, take out a mortgage or have other finance related issues you need to review.

A financial health check is an essential and helpful tool in allowing you to take control and make your finances work for you. Fintuity Virtual Adviser is a highly advanced online tool that delivers instant, bespoke and accurate financial suggestions to you.

Private and Secure

We never disclose your personal data to third parties and use the highest security protocols to ensure that your data is kept safe and secure

Quick & Easy to Use

Take our quick and easy to use questionnaire to get a comprehensive report that will give you a better understanding of your financial landscape

Highly Accurate

Using our unique AI and the latest machine learning our tool gives you an accurate report and offers guidance on how to improve your financial situation

We can help you with

Portfolio

Ensuring you aren’t spending more than you earn is a good starting point and allows you to plan and make important changes to shore up your financial situation.

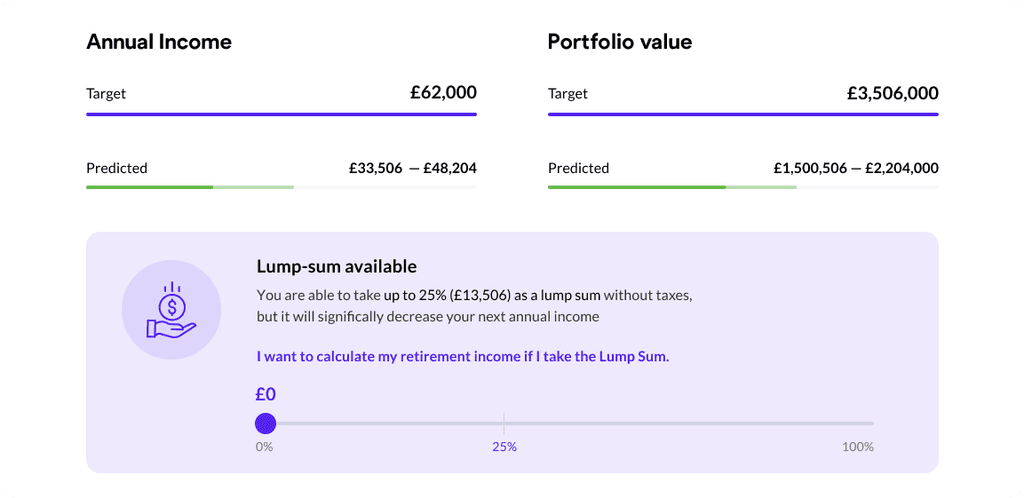

Pension

Using our pensions tool will help give you a clearer understanding of the options available to you, whether you are just starting to save or close to retirement.

Debt management

Our tool will provide a clearer picture of your liabilities allowing you to make changes and improve your financial future.

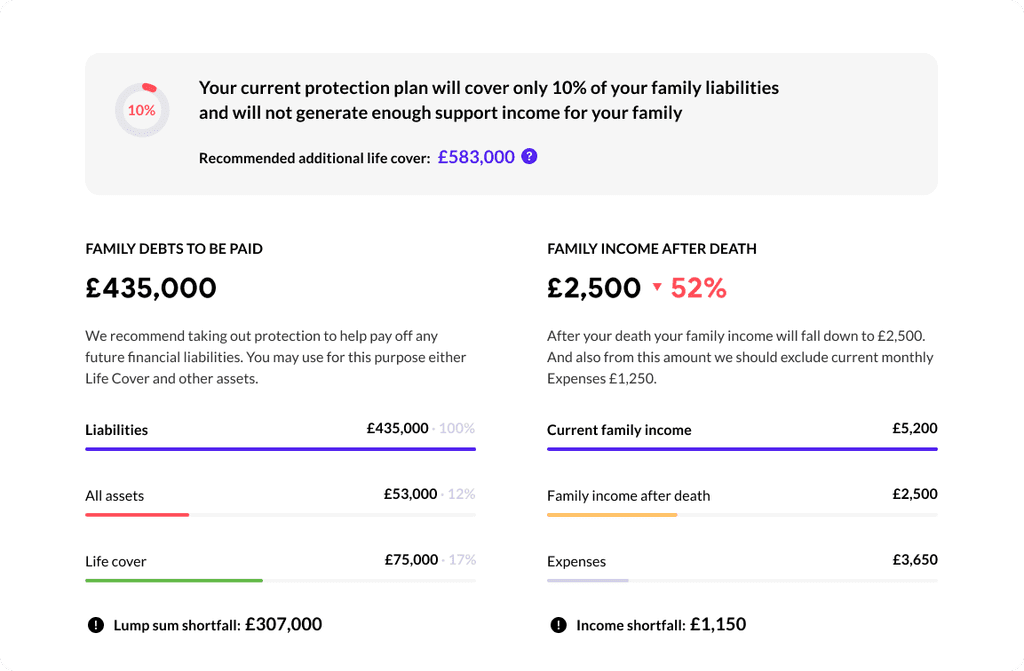

Protection

Our protection tool will provide you with options on how best to protect you and your loved ones should the worst happen.

Take a checkup on your financial health

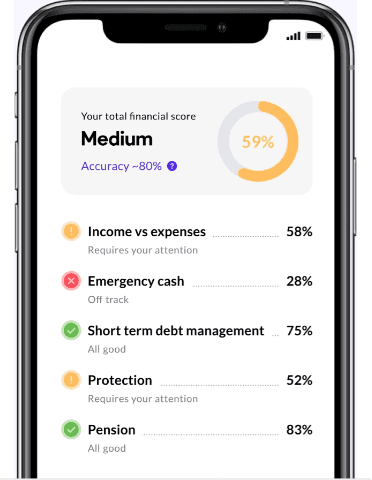

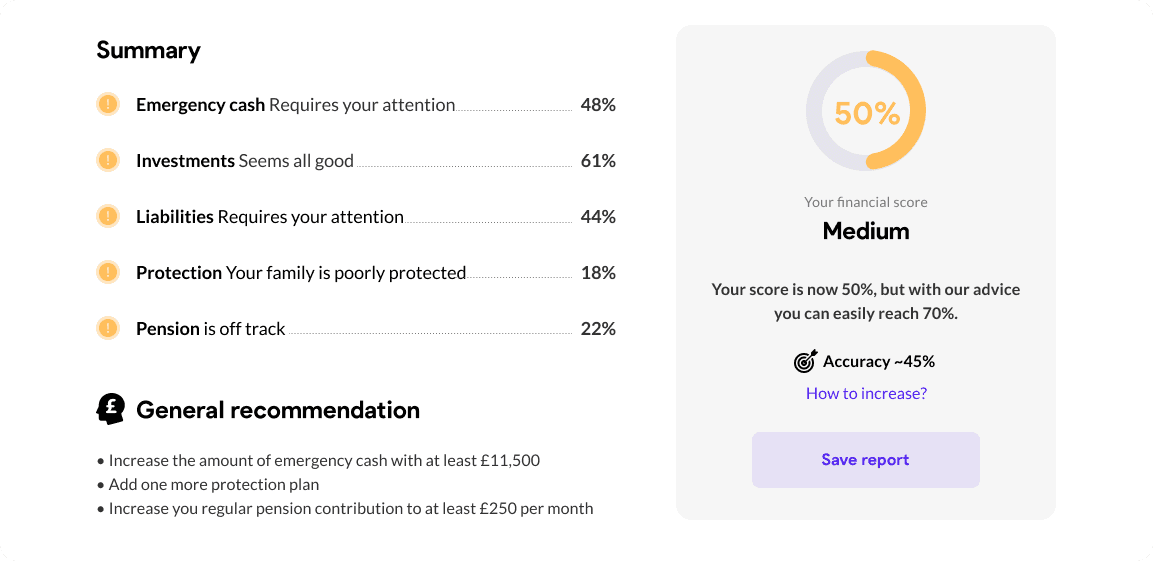

Our complimentary financial health check is designed to give you a complete financial checkup. It will diagnose the areas of your finances that need attention and provide you with options to improve your financial future.

The health check reviews 5 key areas: How much emergency cash you need, investments, liabilities, protection and pensions. The tool doesn’t take long to complete and you can save your progress as you go.

Fintuity in the media

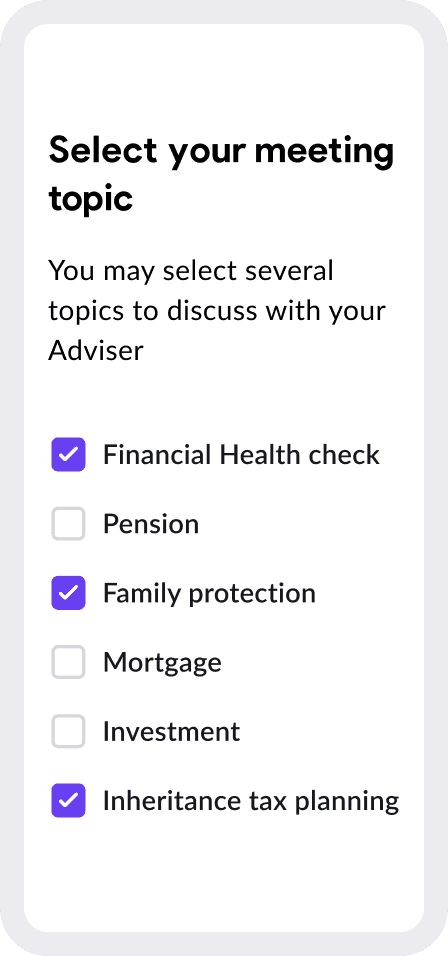

Book a free consultation

Your first consultation is completely free of

charge - all you need to do is to select a

convenient time & date and outline how we can

assist you.